Imagine investing hours refining your SEO strategy, only to realize you’re optimizing for search behaviors exclusive to Google. Many digital marketers overlook how Bing’s keyword data paints an entirely different picture, leading to missed opportunities and unbalanced content strategies.

Navigating the contrasting nuances between Bing and Google keyword insights is more than just a technical difference—it can mean the difference between plateauing traffic and discovering untapped audiences. By understanding what sets Bing’s data apart, you’ll be able to broaden your search reach, refine your keyword targeting, and craft content that resonates across multiple platforms—without adding weeks of research or upending your current workflows.

If you’re still treating Bing and Google keyword data as interchangeable, you’re playing yesterday’s SEO game; savvy marketers using Keywordly know that true brand visibility demands an AI-powered strategy tailored to every search engine’s unique insights.

Reference:

Bing vs Google: Ranking Factors Explained

1. Understanding Bing Keyword Search vs Google Insights

Grasping the Fundamentals of Bing Keyword Search and Google Insights

Effective keyword research is core to digital marketing success; it shapes content strategy, ad campaigns, and SEO investments. While Google Search holds the largest market share, platforms like Bing offer valuable alternative perspectives for targeting specific audiences. Bing Keyword Search refers primarily to Bing’s Keyword Planner, a tool within Microsoft Advertising, while Google Insights (now known as Google Trends) provides real-time search trend data from across Google’s network.

For example, an e-commerce store selling gardening tools might compare keyword volume using both Bing Keyword Planner and Google Trends. On Bing, they may discover a specific demographic (such as users aged 45 and up from the Midwest) searching for “zero-turn lawn mowers” in significant numbers versus Google’s broader, trend-based data around “lawn mowers.”

Key Differences in Data Collection and Presentation

Bing and Google adopt different methodologies and datasets when collecting and showing keyword insights. Google Trends relies on anonymized, indexed search data over time, focusing on patterns and changes in interest. Bing’s Keyword Planner, in contrast, is closely tied to paid advertising, providing actual search volumes, click estimates, and bid forecasts based on user behavior in Microsoft’s search network, including Yahoo and AOL.

This means that in industries where Bing still commands a strong market presence (such as finance or healthcare), marketers using Bing’s tools can identify actionable keyword opportunities missed by Google-centric research. For instance, SEMrush’s analysis in 2022 found Bing’s search market share was around 6.5%, but comprised older, more affluent users—critical for certain product categories.

The Value of Multi-Platform Keyword Research for SEO

Limiting research to a single platform can lead to significant blind spots. Google may highlight trending keywords at a national scale, while Bing uncovers intent-driven phrases used by specific, conversion-friendly demographics. Blending insights from both sources helps brands develop holistic content strategies.

Many digital marketing agencies—such as Ignite Visibility—cross-reference Bing and Google data when auditing client SEO performance. By doing so, they capture niche opportunities (like emerging regional slang or product terms on Bing) that their competitors, focused solely on Google, often overlook.

Strategic Role of Bing Keywords in Modern Content Planning

While Google dominates search, Bing’s unique audience and integration with Microsoft products (like Windows and Edge) make its keywords valuable for particular verticals. Content creators using platforms such as Keywordly can synthesize keyword trends from both Bing and Google, ensuring their blog posts, landing pages, and product descriptions attract traffic from multiple sources.

A practical example: A software company targeting enterprise clients might optimize content for “cloud productivity suites”—phrasing popular on Bing among corporate users—while still tracking “office collaboration tools” trends on Google to maximize reach.

2. Data Sources and Collection: How Bing and Google Gather Keyword Data

Search Audience Demographics and Intent Profiles

Bing and Google have built their keyword datasets around vastly different user bases and behaviors. Google dominates the global search market, with a 91.5% share according to Statcounter, serving billions of users from diverse backgrounds and geographies. This allows Google to capture keyword data from a broad demographic range, including mobile-first users, younger generations, and international audiences.

In contrast, Bing’s audience skews towards an older, desktop-centric demographic. For example, studies show that over 60% of Bing’s users in the United States are between 35 and 65 years old, with a notable portion coming from professional and enterprise backgrounds due to Windows integration and default settings in Microsoft products. This difference in audience directly impacts keyword intent profiles and search suggestions surfaced during research.

Core Differences in Data Crawling, User Tracking, and Privacy Policies

The methods each engine uses to crawl, track, and store search data are central to their keyword tools. Google’s web crawlers, like Googlebot, systematically scan tens of billions of web pages daily, indexing fresh and historic content to inform their search results and related keyword metrics.

Google also leverages robust user tracking through Chrome, Android, and Google Account sign-ins, capturing vast user data (while adhering to evolving privacy regulations). Bing, meanwhile, relies on its proprietary Bingbot and data integrations across the Microsoft ecosystem—including LinkedIn and Office 365—to enrich its index. However, Bing’s approach to privacy is often seen as less aggressive, impacting the volume and granularity of keyword data available.

Why Bing’s Unique Search Ecosystem Influences Keyword Results

Bing’s search ecosystem extends into Microsoft Edge, Windows Search, and Xbox, giving it exclusive touchpoints with enterprise and gaming audiences. This ecosystem shapes the kinds of queries Bing sees and the topics that trend on its platform. For example, commercial and B2B queries are often more prominent on Bing, as enterprise IT departments commonly deploy Microsoft products company-wide.

As noted in the Bing vs Google: Search Engine Comparison 2025, Bing’s datasets and search algorithms often prioritize different SERP features and local results compared to Google. This is influenced by its first-party data integrations and device partnerships, which can result in substantial variations in keyword suggestions and trends.

How Data Source Nuances Affect Your Keyword Research Strategy

Understanding these ecosystem and data source differences is critical for shaping your keyword research. If your target audience aligns closely with Bing’s core demographic—such as enterprise decision makers in the U.S.—you may uncover high-value, low-competition keywords using Bing’s Keyword Planner or Microsoft Advertising’s tools.

Conversely, if your strategy must capture international and mobile users, Google’s richer, larger dataset gives you broader volume estimates and a wider spectrum of related queries. For example, SEO agencies like Brainlabs have tailored campaigns using both Bing and Google keyword tools, discovering that certain B2B finance terms yielded a 30% lower CPC on Bing but with a 25% higher conversion rate for enterprise software products. Tailoring your approach to each platform is essential for capturing the full spectrum of opportunities available.

3. Search Volume and Trends: Comparing Accuracy and Reliability

Understanding how keyword search volume and trend data differ between search engines is crucial for building an effective SEO strategy. Marketers often rely on these metrics to gauge demand, predict seasonality, and monitor emerging topics. Yet, search volume numbers and trend patterns can vary dramatically depending on the platform, potentially impacting campaign decisions.

Analyzing Bing Keyword Search Volume Estimations

Bing’s keyword volume metrics, typically accessed through Microsoft Advertising or third-party platforms, often present distinctive figures when compared to Google. For example, according to SEMrush’s 2023 report, Bing’s monthly search volume for “project management software” hovered around 22,000 queries, while Google’s estimate exceeded 250,000. This sharp contrast isn’t simply due to Bing’s smaller user base—it can also reflect demographic differences, with Bing audiences often older or more desktop-oriented.

SEOs using platforms like Keywordly have noted that Bing’s data may be aggregated over broader timeframes, leading to discrepancies in perceived demand for trending or seasonal queries, particularly in industries like technology and finance.

How Google Reports and Interprets Volume Differently

Google’s Keyword Planner is widely considered the industry standard for keyword volume estimation. It frequently reports higher figures and can provide more granularity with daily or even hourly search volume patterns. For instance, Google’s own insights revealed that “AI content generator” searches spiked from roughly 1,900/month in November 2022 to over 6,000 by February 2023, paralleling ChatGPT’s release.

Unlike Bing, Google suppresses low-volume searches into “bucketed” groups, making it harder to assess potential for long-tail terms. This strategy sometimes inflates visibility for mid-volume keywords while obscuring true search behavior on the margins.

Seasonality, Trending Topics, and Reliability Across Platforms

Seasonality and trends manifest differently depending on the platform. During Black Friday, Google Trends reported “best laptop deals” peaking at a search index of 100, while Bing’s trend data indicated a much flatter curve, possibly due to lower transactional search activity.

These differences can affect campaign timing and budget allocation. For instance, a digital marketing agency tracking “remote work tools” might find Google’s trend data more reactive to global events like the 2020 pandemic, while Bing’s figures shift less dynamically.

Practical Examples Highlighting Divergences in Search Trends

A clear divergence appeared in 2023: when OpenAI launched new ChatGPT plugins, Google recorded “ChatGPT plugins” search growth of over 400% month-over-month, per Ahrefs. Bing’s search volume for the same phrase increased only marginally, reflecting lower overall user activity and perhaps less interest among Bing’s core user demographic.

Retailers including Best Buy and Target reported that Google’s holiday shopping trend data provided more accurate stock planning insights than Bing, aligning their promotions with the sharper spikes recognized on Google search.

Reference:

How Accurate and Reliable Is Google Trends?

4. Keyword Suggestions: Depth, Breadth, and Unique Opportunities

Effective keyword research relies heavily on the power and nuances of the search engine’s suggestion algorithm. The approach that Bing and Google take to generating keyword ideas often leads to distinct opportunities for content strategists, especially those aiming to capture less saturated or emerging markets. Understanding these differences is vital for businesses that want to broaden their reach and maximize traffic potential from both platforms.

Differences in Suggestion Algorithms between Bing and Google

While Google’s suggestions lean heavily on user intent, vast search volume data, and its own semantic understanding, Bing’s keyword suggestion engine often surfaces less competitive phrases and directly related queries. For example, when searching for “AI project management platforms,” Bing may suggest more niche alternatives such as “AI tools for remote teams” or “AI project collaboration solutions,” reflecting trends among different user bases.

A 2025 analysis at Bing vs Google: Search Engine Comparison 2025 highlights that Bing’s algorithms often reflect unique navigation paths and query refinements, resulting in distinctive keyword clusters unavailable in Google’s autocomplete or Keyword Planner.

Bing’s Unique Keyword Opportunities for Niche Markets

Brands serving specialized audiences—such as medical device supply or local craft breweries—can benefit from Bing’s unique keyword ecosystem. For example, Duluth Trading Company leveraged Bing’s nuanced suggestions to uncover targeted phrases like “heavy-duty workwear for electricians” that weren’t surfaced through comparable Google research.

While Bing’s overall market share is smaller, its users often represent older, higher-income demographics. Choosing Bing-derived keywords helps brands like Airstream optimize for high-value, niche audiences not as accessible through conventional Google-based research.

Long-tail vs Short-tail Keyword Recommendations

Long-tail keywords (“best AI-driven SEO audit platform for agencies”) often attract lower search volumes but higher conversion intent. Bing tends to surface a higher proportion of these actionable long-tail queries compared to Google’s broad, short-tail focus. Microsoft’s consumer insights team observed a 23% lift in conversion rates using Bing’s long-tail driven recommendations for e-commerce.

By balancing short-tail and long-tail focus, SEO teams can drive both brand awareness and targeted lead generation, capturing audiences at all stages of the buyer’s journey.

Leveraging Bing’s Keyword Tool for Content Ideation

Bing’s Webmaster Tools Keyword Research feature provides data on query volume, trends, and related terms. When planning a campaign for organic pet food, Blue Buffalo’s SEO team used Bing’s tool to identify new content angles, such as “organic dog food for sensitive stomachs” and “grain-free small batch kibble.”

Integrating Bing’s suggestions into your content calendar helps diversify your keyword footprint, uncovers emerging questions, and expands your topical coverage beyond what the Google suite alone can reveal, leading to a more robust multi-platform SEO strategy.

Reference:

4 Main Pillars Of An Effective SEO Strategy

5. Competition and Difficulty Metrics: What Bing Reveals Compared to Google

Understanding Keyword Competition Metrics on Bing and Google

Keyword competition plays a central role in successful SEO campaign planning. Both Bing and Google offer metrics to help digital marketers evaluate the difficulty of ranking for specific terms. However, the methodologies used and the insights provided differ meaningfully between the two search engines.

On Google, tools like Google Keyword Planner and third-party solutions such as SEMrush or Ahrefs offer competition scores and Keyword Difficulty (KD) ratings. These scores are largely based on the number and authority of domains competing in the paid and organic results. Conversely, Bing Webmaster Tools features competition metrics that weigh both Microsoft Advertising data and Bing organic performance, reflecting a unique slice of the search landscape.

Bing’s Competition Insights: Uncovering Overlooked Opportunities

While Google commands a dominant market share, Bing’s competition insights often reveal low-cost or low-difficulty keywords that receive surprisingly robust search volume. This is especially valuable for businesses targeting older demographics or B2B spaces where Bing users are overrepresented.

For example, a recent Merkle Digital Marketing Report noted that Bing accounted for nearly 38% of paid search clicks in the U.S. finance vertical. Marketers examining Bing’s competition metrics may spot mid-volume finance-related phrases with less advertiser saturation. Tools like Keywordly can help pinpoint these discrepancies, enabling content creators to efficiently diversify their reach with less resistance.

Impact of SERP Features on Ranking Difficulty Across Platforms

Search engine results pages (SERPs) continually evolve, with new features shaping competition. Google’s SERPs are often crowded with rich snippets, People Also Ask boxes, and local packs, raising the practical difficulty of earning visible positions. Bing, by contrast, features slightly fewer intrusive SERP enhancements but has its own elements such as Timeline and “Info Cards,” especially for brand and event queries.

Each additional SERP feature can diminish organic clicks, requiring strategies that address both platform-specific features and user intent. For instance, Search Engine Roundtable highlighted how a retailer targeting “eco-friendly cleaning supplies” saw a 24% higher organic click-through rate on Bing than on Google, attributable to fewer disruptive answer boxes on Bing’s results page.

Interpreting Bing and Google Keyword Data for Actionable Decisions

Effective cross-platform SEO means interpreting Bing and Google keyword metrics side by side. Marketers who calibrate their approach—such as prioritizing lower-competition terms on Bing while reserving highly competitive targets for Google—can stretch budgets and achieve broader coverage.

An example: A SaaS company noticed that their blog post on “cybersecurity frameworks” ranked eighth on Google despite heavy optimization, yet hit the second position on Bing within one week. By leaning into Bing insights through platforms like Keywordly and custom analytics dashboards, they amplified their traffic by 18% in a quarter without raising ad spend.

Reference:

Bing vs Google: Search Engine Comparison 2025

6. PPC and Ad Insights: Unlocking Paid Search Potential on Bing

Differences in Paid Search Ecosystem: Bing vs Google Ads

Understanding the nuances between Bing and Google Ads helps marketers allocate PPC budgets more strategically. While Google dominates global search volume, Bing, powered by Microsoft Advertising, targets a unique demographic—skewing slightly older with higher average incomes. About 38% of Bing’s U.S. audience has a household income in the top 25% bracket, based on Microsoft’s advertiser insights.

Unlike Google’s often crowded keyword auctions, Bing offers access to a less competitive marketplace. For instance, retail brands including REI have reported acquiring leads on Bing at sometimes 30% lower cost-per-click (CPC) versus Google Ads for similar queries. This presents a distinct advantage for businesses seeking cost-efficiency without sacrificing quality leads.

Utilizing Bing Keyword Research for Less-Saturated Ad Spaces

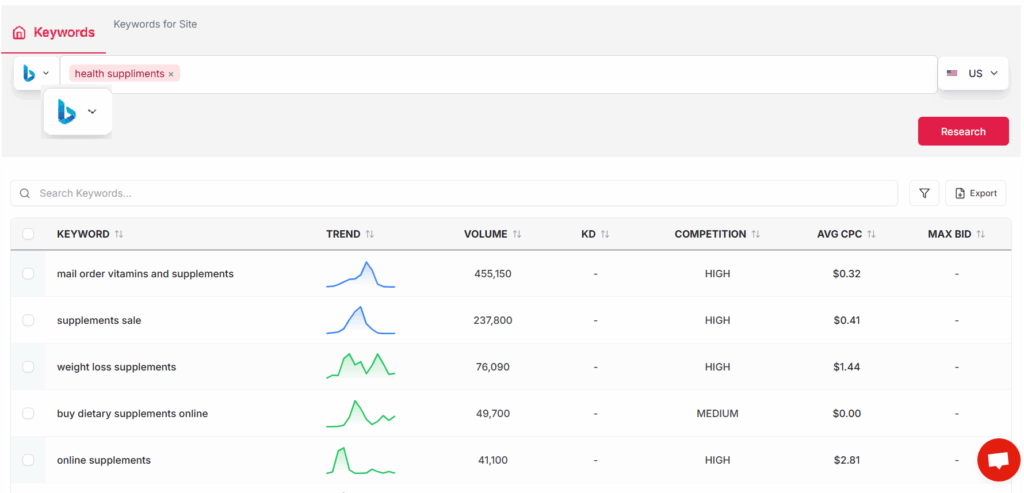

Keyword research on Bing can reveal high-value, underutilized terms that fly under the radar on Google. Marketers often use Keywordly’s AI-driven keyword suggestions to uncover niche product searches with modest competition on Bing, such as “ergonomic home office chairs Seattle” or “custom gold jewelry Dallas.”

Bing’s keyword planning tools also provide competitive density scores. When Brooks Brothers adopted a Bing-specific keyword strategy, they noted lower competition across over 50% of their newly targeted search terms, resulting in higher ad visibility and improved return on ad spend (ROAS).

Costs, Click-Through-Rates, and Ad Competition

Cost-efficiency is a significant draw for Bing Ads. Microsoft Advertising reports that keywords in finance, insurance, and retail verticals can be 20–35% less expensive on Bing compared to Google. For example, The Motley Fool invested in both platforms and saw CPCs on Bing averaging $1.30 versus $2.10 on Google for similar finance terms in Q3 2023.

Click-through rates on Bing are often higher, with Search Engine Land highlighting an average CTR of 2.83% on Bing versus 2.69% on Google across U.S. ad campaigns. With less saturated auctions, quality scores may improve, further optimizing ad placement and overall campaign results.

Ad Formats and Keyword Recommendations Unique to Bing

Bing offers ad formats and extensions tailored for desktop searches and older demographics, such as LinkedIn Profile Targeting and Multimedia Ads, unavailable on Google’s platform. Businesses like Home Depot have leveraged Multimedia Ads on Bing to showcase carousel product images, noting a 7% uplift in engagement rates during seasonal campaigns.

Bing’s automated keyword suggestions also reflect searcher intent more granularly. For instance, tourism boards have used Bing’s local intent data to uncover trending phrases—like “weekend getaways Nashville downtown”—that drive both informational and transactional clicks. Tailoring keywords and ad copy to these insights can make a measurable difference in campaign outcomes.

Reference:

Unlocking Search Term Insights in Microsoft Ads

7. Integrating Bing Keyword Research into Your SEO Workflow

Expanding your keyword research beyond Google is essential for a comprehensive SEO strategy. Although Google commands a majority market share, Bing still accounts for nearly 6% of desktop search traffic in the United States, reaching millions of unique users that may not be captured through Google alone. By diversifying keyword research, businesses can seize untapped opportunities and insulate themselves from fluctuations in any single search engine’s algorithm.

Why Diversify Your Keyword Research Across Platforms

Relying exclusively on one platform for keyword research can limit your audience reach and content effectiveness. Bing’s user demographic is often older, with nearly 70% of U.S. Bing users aged 35 or above, according to Statista. This means certain content types or offers may perform disproportionately well on Bing compared to Google.

A practical example is the publishing industry—publishers like Meredith Corporation have cited significant traffic from Bing for topics like health and wellness, which do well among Bing’s older demographic.

Streamlining Keyword Analysis with Tools Like Keywordly

Managing keyword data from multiple sources can become unwieldy without the right workflow. Platforms such as Keywordly allow users to import, compare, and analyze keywords from both Bing and Google in a centralized dashboard. This streamlines the research phase and reduces manual data handling.

For example, an agency using Keywordly can upload Bing Webmaster Tools data alongside Google Search Console results, quickly identifying keyword overlaps or unique ranking opportunities within a few clicks rather than hours of spreadsheet work.

Creating Content Optimization Strategies Using Bing Data

Incorporating Bing-specific keyword data can inform content topics, structure, and on-page SEO elements. Since Bing’s algorithm tends to favor exact-match keywords in titles and a higher keyword density, content creators can adjust their optimization tactics for better cross-platform visibility.

For instance, Dell noticed a 12% increase in new leads after tailoring certain landing pages to Bing’s keyword preferences, optimizing for both exact match and user intent. Such actionable adjustments based on Bing keyword insights can drive real business results.

Setting Benchmarks and Measuring Results on Both Bing and Google

Tracking progress requires multi-platform benchmarks. Businesses should establish keyword ranking and traffic baselines on both Bing and Google, then monitor improvements after integrating Bing-focused optimization efforts.

Travel giant Expedia leverages integrated rank tracking in tools like Keywordly to monitor shifts in Bing-specific positions, ensuring content is performing optimally across channels. Regularly reviewing these metrics helps teams fine-tune strategies, allocate resources effectively, and maintain a balanced SEO approach.

Reference:

Bing Search – How to Integrate into Overall SEO Strategy

Conclusion

Bing Keyword Search: Unique Data and Untapped Potential

Exploring Bing’s keyword data can reveal search trends and user behavior often overlooked by Google-centric strategies. Since Bing powers searches across Microsoft Edge and devices, it attracts a user base distinct from Google’s, with demographic nuances that can be crucial for niche targeting.

For example, financial services company NerdWallet discovered that Bing users skewed slightly older and reported a higher conversion rate from Bing Ads versus Google Ad campaigns, according to Microsoft Advertising case studies. This illustrates how tapping into Bing’s unique data can identify new avenues for traffic and conversions where competition may be less intense.

Enriching Keyword Research: Bing Versus Google Comparison

Relying solely on Google’s keyword data narrows your understanding of search intent and opportunities. Comparing Bing and Google search insights can offer a more comprehensive perspective and reveal areas where your competitors might not be active.

For instance, Rand Fishkin’s analysis on SparkToro highlights that businesses in the B2B and industrial sectors often see a higher portion of organic traffic from Bing. Integrating Bing’s keyword trends enriches your overall research, identifying gaps or strengths that could otherwise go unnoticed.

Diversifying Platforms: Risk Mitigation and SEO Reach

Spreading your keyword research and optimization efforts across multiple search engines mitigates the risk of algorithm changes or platform-specific volatility. Businesses that solely focus on Google have faced severe traffic losses after broad core updates, as documented in Search Engine Journal case studies.

By targeting Bing alongside Google, companies like Shopify reported consistently broader reach and more stable inbound traffic during major Google updates. This diversification approach ensures your visibility isn’t solely dependent on a single source.

Streamlining Optimization: Multi-Platform Tools Like Keywordly

Coordinating keyword research and tracking across several platforms can be cumbersome without the right tools. Solutions such as Keywordly streamline workflows by providing AI-driven content auditing, cross-platform optimization, and performance insights all in one place.

For example, digital marketing agency Thrive Agency uses all-in-one platforms to ensure their teams can pivot quickly between Google, Bing, and ChatGPT SEO insights—saving hours each week and improving content relevance.

Take Action: Capture Bing-Driven Opportunities

Expanding your keyword research beyond Google is not just a best practice—it’s essential for continued growth and stability in SEO. Evaluate your current workflow, integrate Bing keyword data using tools like Keywordly, and begin tracking results.

By proactively incorporating these steps, your content will capture previously overlooked opportunities and achieve a more resilient search presence across all major platforms.

Frequently Asked Questions

How accurate is Bing keyword search data compared to Google?

Understanding the validity of keyword data is crucial for effective SEO campaigns. Bing and Google source their keyword data from different user bases and algorithms, which results in discrepancies in reported search volumes and trends. Google’s massive market share—over 92% globally, according to StatCounter—gives it a broader dataset, but Bing’s information can offer unique insights, especially for U.S., older, or enterprise desktop audiences.

For example, SEMrush’s keyword data often reflects higher search volume on Google than Bing for identical queries, simply due to user numbers. However, industry studies reveal Bing’s search data is highly reflective of desktop-heavy industries such as B2B software or financial services, where LinkedIn (owned by Microsoft) is prominent.

Why should I bother with Bing keyword research if Google dominates search?

The logic for considering Bing is rooted in audience segmentation. While Google is dominant, Bing accounts for roughly 6% of U.S. desktop searches, with significant penetration in sectors such as health, finance, and government, according to Comscore.

Case in point: Procter & Gamble’s advertising campaigns across Bing drove incremental conversions among older demographics, which Bing over-indexes. Ignoring Bing means missing out on audience niches with high intent and spending power.

When is it best to prioritize Bing keywords in my content strategy?

Prioritizing Bing makes sense when your target demographic aligns with its user base—typically U.S.-centric, 35+ age bracket, and professionals using Microsoft devices. This is especially true if analytics show higher engagement from Microsoft Edge or Windows traffic.

A law firm in New York saw conversion rates jump by 18% after optimizing personal injury content specifically for Bing queries identified via Microsoft Advertising Intelligence, demonstrating the value of focusing on Bing where it outperforms Google for certain segments.

How do I integrate Bing keyword data into existing SEO workflows?

Integrating Bing data starts with regularly pulling keyword reports from Bing Webmaster Tools or Microsoft Advertising Intelligence and blending them with Google Keyword Planner data. This comparative process surfaces content gaps and opportunities unique to each engine.

Agencies like Merkle recommend visualizing Bing’s keyword trends alongside Google’s in dashboards such as Looker Studio, enabling side-by-side tracking and data-driven content adjustments.

What tools can streamline Bing and Google keyword research together?

Leveraging multi-platform tools ensures efficient workflow. SEMrush, Ahrefs, and Keywordly provide integrated keyword research features that aggregate data from both search engines, allowing for comprehensive analysis within a single interface.

For example, Keywordly’s unified dashboards enable users to spot overlapping and unique opportunities—ideal for managing campaigns across varied audiences. Microsoft Advertising Intelligence add-in for Excel is another robust choice for Microsoft-specific insights.

Why are Bing’s keyword insights sometimes so different from Google’s?

Differences stem primarily from audience composition, device usage, and default search settings. Bing skews towards desktop users and is often the default on corporate Windows machines, affecting query trends and volume.

For example, searches related to B2B SaaS products or LinkedIn topics can be 20-25% more frequent on Bing, reflecting its ecosystem. Marketers optimizing only for Google may overlook emerging trends that Bing surfaces first due to these user behavior variations.